Contact Us Now for Expert Financial Coaching and Personalized Advice

Contact Us Now for Expert Financial Coaching and Personalized Advice

Blog Article

Why Prioritizing Your Financial Wellness Consists Of Looking For Specialist Credit Coaching Solutions for Sustainable Financial Debt Alleviation

Accomplishing lasting financial obligation alleviation includes even more than just making settlements; it needs a strategic strategy that resolves the origin creates of economic distress. By employing the guidance of specialists in credit coaching, individuals can obtain useful understandings, sources, and support to navigate their means towards economic security.

Benefits of Specialist Credit Score Therapy

Taking part in skilled credit history counseling can provide individuals with customized monetary strategies to effectively manage and decrease their financial obligation worry. One essential advantage of expert credit therapy is the customized strategy that specialists supply. By assessing a client's economic situation thoroughly, credit score therapists can develop customized financial obligation management intends that suit the individual's certain requirements and goals. These tailored methods might consist of budgeting methods, financial obligation combination choices, negotiation with lenders for reduced interest rates, and assistance on improving credit rating.

In addition, professional credit scores therapy services commonly provide useful education and learning on monetary proficiency and money administration. Customers can get insights into liable costs behaviors, cost savings approaches, and long-lasting planning for monetary stability. This expertise empowers individuals to make educated choices regarding their financial resources and create healthy economic habits for the future. In addition, credit rating therapy can provide psychological support and support throughout challenging times, assisting individuals remain inspired and dedicated to their financial obligation settlement trip. Overall, the advantages of skilled credit therapy prolong beyond financial obligation relief, helping people construct a strong structure for long-lasting economic wellness.

Recognizing Debt Relief Options

When dealing with overwhelming debt, people need to very carefully assess and recognize the different available options for financial obligation alleviation. One common financial obligation alleviation alternative is debt loan consolidation, where multiple financial obligations are incorporated into a single car loan with a reduced interest rate.

Bankruptcy is a much more drastic debt alleviation alternative that should be considered as a last option. It involves a lawful process where financial obligations are either reorganized or forgiven under the protection of the court. However, insolvency can have durable consequences on debt and economic future. Seeking expert credit rating counseling solutions can aid people examine their economic situation and determine one of the most appropriate financial debt alleviation option based upon their certain scenarios.

Establishing a Personalized Financial Plan

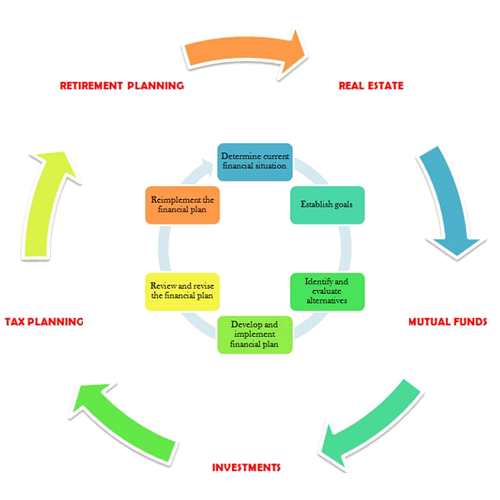

Considering the numerous financial obligation relief choices offered, it is vital for people to create an individualized monetary strategy customized to their details circumstances. An individualized economic plan serves as a roadmap that lays out a clear course in the direction of accomplishing economic stability and flexibility from financial obligation.

Next, setting particular and realistic monetary goals is important. These goals can consist of paying off a certain quantity of debt within a defined duration, boosting financial savings, or improving debt scores. With clear goals in position, individuals can after that create a budget that allocates funds towards financial debt payment, savings, and essential expenditures. Consistently readjusting this budget click this site and keeping an eye on as needed is necessary to stay on track in the direction of financial objectives.

Furthermore, looking for expert credit therapy solutions can offer important advice and support in developing an individualized financial strategy. Credit score therapists can offer professional recommendations on budgeting, debt administration methods, and economic preparation, aiding individuals make informed decisions to protect a stable financial future.

Relevance of Budgeting and Saving

Effective monetary monitoring via budgeting and saving is essential to attaining long-term monetary security and success. Budgeting allows people to track their earnings and expenditures, enabling them to prioritize spending, identify locations for possible financial savings, and avoid unneeded financial debt. By developing a budget plan that lines up with their monetary goals, individuals can efficiently prepare for the future, whether it be building a reserve, saving for retirement, or buying assets.

Conserving is similarly essential as it supplies a financial safeguard for unanticipated expenditures and aids people work towards their financial objectives. Developing a routine saving routine not only fosters monetary discipline however likewise guarantees that people have funds offered for future possibilities or unanticipated circumstances. In addition, saving permits individuals to expand their wide range in time via rate of interest buildup or investment returns. In significance, saving and budgeting are foundation practices that empower people to take control of their financial resources, decrease economic anxiety, and work towards achieving lasting monetary safety and security.

Long-Term Financial Stability

Accomplishing lasting financial stability is a strategic quest that demands careful planning and regimented monetary administration. To safeguard long lasting economic well-being, individuals need to concentrate on developing a learn this here now solid economic structure that can withstand unexpected costs and financial fluctuations. This foundation includes developing a reserve, managing debt sensibly, and investing for the future.

One key facet of lasting financial stability is creating a sustainable budget that aligns with one's economic objectives and discover this info here top priorities. Preparation for retirement very early and regularly contributing to retirement accounts can aid people safeguard their monetary future.

Final Thought

In verdict, looking for specialist credit scores therapy services is important for achieving sustainable financial obligation relief and long-term financial security. By comprehending financial obligation alleviation choices, developing a customized financial plan, and focusing on budgeting and saving, people can efficiently handle their finances and work in the direction of a secure monetary future. With the advice of credit history counsellors, people can make educated choices and take positive actions towards improving their monetary health.

An individualized economic plan offers as a roadmap that details a clear course in the direction of accomplishing financial security and liberty from debt. In conserving, budgeting and essence are keystone techniques that encourage people to take control of their financial resources, decrease monetary anxiety, and job in the direction of attaining long-term financial safety and security.

To protect lasting financial health, people have to concentrate on developing a strong monetary foundation that can withstand unanticipated expenditures and economic fluctuations - contact us now. By leveraging professional support, individuals can browse monetary challenges a lot more effectively and work in the direction of a sustainable financial obligation relief strategy that supports their long-lasting financial health

Report this page